If you get paid every other week, you probably look forward to the months when you receive three paychecks instead of only two.

For most of my career as a salaried employee, I was paid biweekly and received 26 paychecks a year. That’s two more than people who are paid twice a month.

Take a look at the math:

- Biweekly: 52 weeks ÷ 2 = 26 paychecks

- Twice a month: 12 months × 2 = 24 paychecks

Every year, I would pull out a calendar and identify the three paycheck months based on my employer’s pay schedule.

3 Paycheck Months in 2022 if You’re Paid Every Other Friday

Although I’m no longer paid biweekly, I’ve continued this tradition for the past few years on MichaelSaves.com.

Here are the three paycheck months that I’ve identified for 2022:

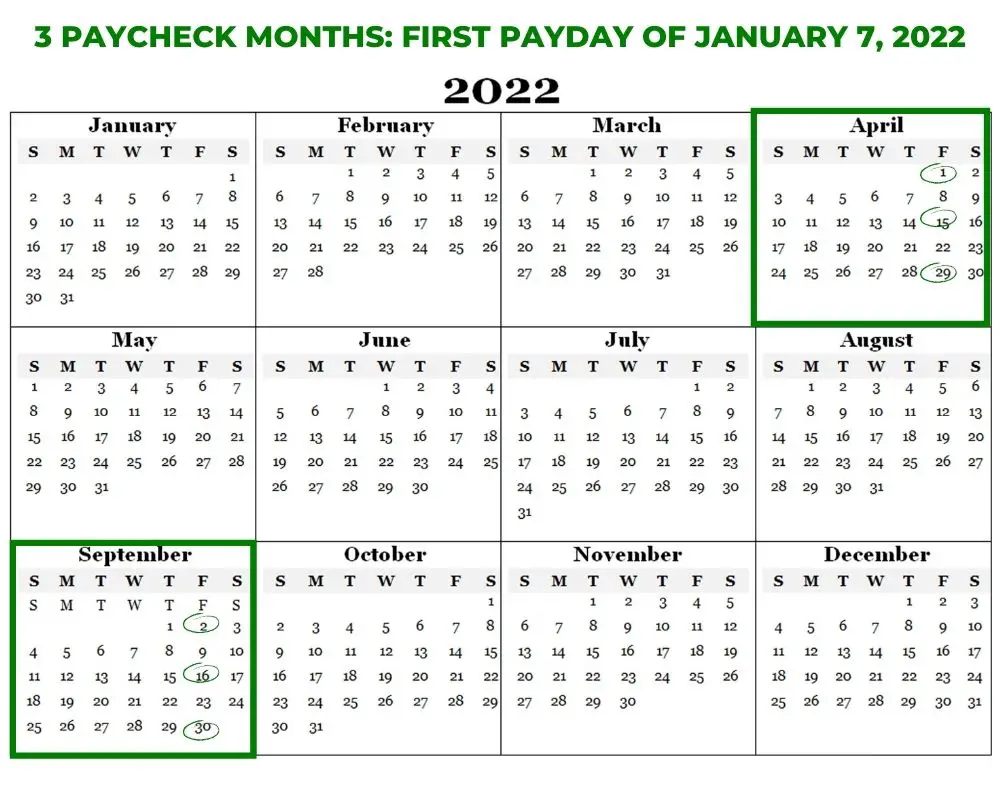

- If your first paycheck of 2022 is Friday, January 7, your three paycheck months are April and September.

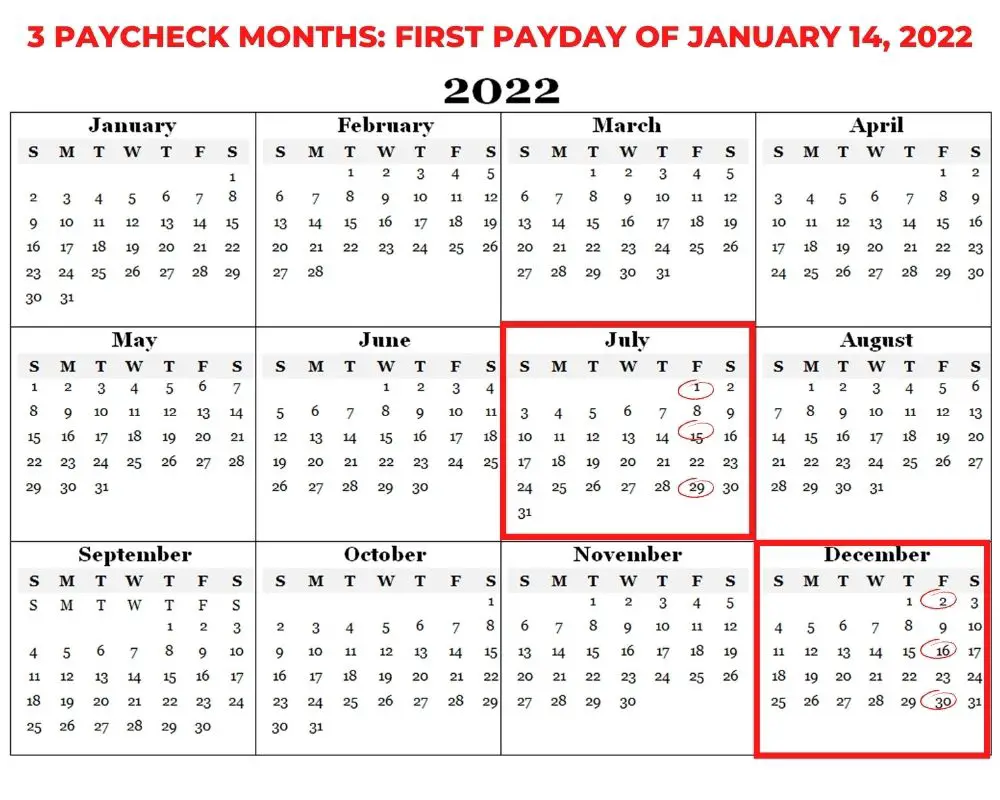

- If your first paycheck of 2022 is Friday, January 14, your three paycheck months are July and December.

Want a preview of the three paycheck months for 2023? I’ve got you covered here!

List of Every Friday Biweekly Payday in 2022

First Paycheck of 2022: Friday, January 7

- January 7

- January 21

- February 4

- February 18

- March 4

- March 18

- April 1

- April 15

- April 29

- May 13

- May 27

- June 10

- June 24

- July 8

- July 22

- August 5

- August 19

- September 2

- September 16

- September 30

- October 14

- October 28

- November 11

- November 25

- December 9

- December 23

First Paycheck of 2022: Friday, January 14

- January 14

- January 28

- February 11

- February 25

- March 11

- March 25

- April 8

- April 22

- May 6

- May 20

- June 3

- June 17

- July 1

- July 15

- July 29

- August 12

- August 26

- September 9

- September 23

- October 7

- October 21

- November 4

- November 18

- December 2

- December 16

- December 30

The example shown above is only for employees who are paid every other Friday.

If you’re paid biweekly but not on Fridays, identify your three paycheck months for 2022 by pulling out a calendar, marking your paydays and finding the months with three of them.

Make a Plan for Your Third Paychecks

If you determine your three paycheck months in advance, you can make a plan for how you’ll spend the money and reach your savings goals faster.

To simplify the budgeting process, I’ve always recommended that people who are paid biweekly build their monthly budget based on receiving two paychecks a month and not a penny more!

And during the months when you receive three paychecks instead of two, treat the money as a bonus!

Need some ideas for how you’ll spend, save or invest your third paychecks? Here are just a few of the ways I’ve taken advantage of three paycheck months in the past:

- Pay down mortgage principal

- Pay a semi-annual bill like auto insurance

- Fund a home improvement project

- Add to the emergency fund

- Invest in a Roth IRA

- Save money for Christmas presents

- Book a weekend trip

What’s your strategy for your three paycheck months in 2022? Let me know in the comments below and see this step-by-step guide to learn about my personal budgeting strategy.