Do you have a weekly money routine? I spend about 10 minutes a week going through a financial checklist that’s helped me increase my net worth drastically over the last decade.

In this article, I’ll share my personal checklist and the five habits that can help you improve your finances. Let’s dive in!

1. Review Empower

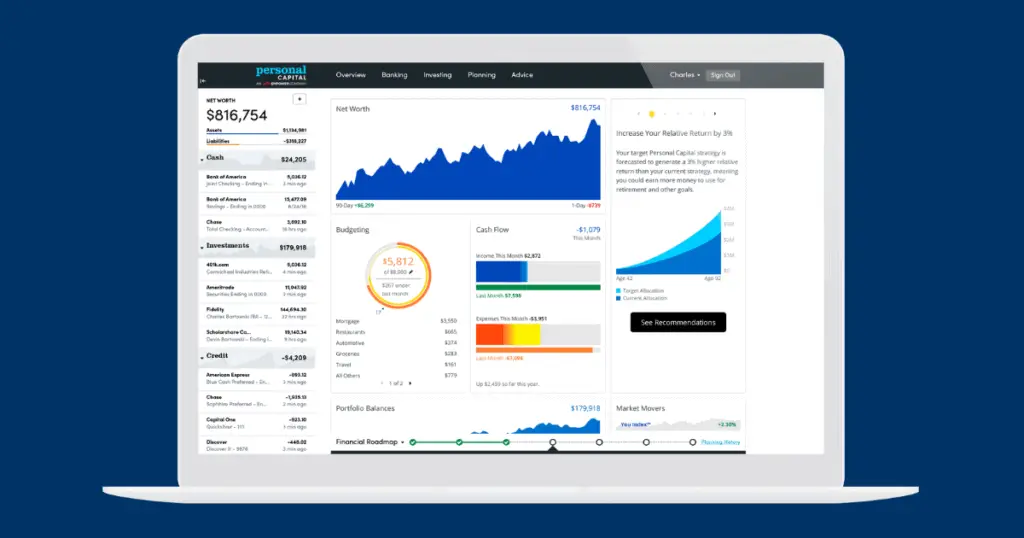

The first step is to log in to the Empower (formerly Personal Capital) dashboard. If you’re unfamiliar, Empower offers free tools that sync up your financial accounts and track your net worth.

I primarily use Empower because I like its free retirement planner.

For my weekly financial checklist, I look for my current net worth. That’s simply the value of your assets, minus your liabilities.

Empower puts this information front and center when you log in. Here’s a sample dashboard:

Don’t be discouraged if your net worth doesn’t change much from one week to the next. It may not fluctuate much during a single week, but you want to see it increase over time.

The purpose of starting my weekly money check-in with this step is just to see if I’m on the right track.

You’ll need to sync your financial accounts with Empower to get an accurate net worth. However, you can always calculate your net worth manually by listing your assets and debts.

2. Check Bank Account Balances

The second step is to log in to your primary bank account to check your balance. Specifically, you want to review the balance of the checking account that you use for most or all of your bills.

For this step, I review my recent transactions and make sure that I have enough money in my checking account to cover my upcoming bills.

What’s the magic number? That’ll depend on your money situation, but here’s what works for me:

As a general rule, I keep a checking account balance that’s equal to two or three mortgage payments. Everything else goes to savings.

I’m able to keep a relatively low checking balance because I bank with Discover Bank, which charges no fees.

And if I’ve made a big purchase that I need to pay off, I’ll take this opportunity to transfer money from my savings account to my checking account.

Learn more about my checking account rule in this post.

3. Pay Credit Card Bills

The third step of the financial checklist is to pay your credit card bills. There are three primary reasons why I make credit card payment weekly instead of monthly:

- I never miss a payment: By paying off my credit cards in full every week, I never have to worry about late fees.

- It helps me stay on budget: When I log in to my credit card accounts weekly, I review my recent transactions. This helps me identify problem spending faster.

- My credit score gets a boost: Payment history and credit utilization affect your credit score the most.

If you can’t pay off your credit card bills in full every week, try to make the minimum payment every week to pay less interest and get out of debt faster.

While logged in to my accounts, I also check for any deals through portals like Amex Offers and Chase Offers.

Your credit card companies have information on all of your purchases, so sometimes they will offer limited-time discounts on things that you already buy.

My favorite? When there’s $15 or $20 off a month of a streaming service like YouTube TV.

NOTE: If you’re trying to improve your credit score, I recommend that you check it for free on a weekly basis. Your credit card issuer may offer free credit scores from your dashboard.

RELATED: The Big 3 Strategy to Maximize Cash Back Rewards

4. Pay Any Other Bills

The fourth step is to pay any other bills that you received over the last week. When I get a bill in the mail, I just set it aside until I tackle my weekly financial checklist.

To be honest, this doesn’t happen often because I have most of my fixed expenses on auto pay.

To be clear, I use auto pay only for fixed expenses like my mortgage, utilities and insurance payments. For variable expenses that I put on credit cards, I log in every week to pay them.

Learn more about when to use auto pay and when it may not be a good idea.

5. Review and Tweak Monthly Budget

The fifth and final step is to review your monthly budget and make any tweaks if they’re needed.

For my budgeting method, I use the Google Sheets app on my smartphone to look over my budget before I make a purchase and then I record the transaction immediately after.

That means I’m reviewing my budget daily, so this weekly check-in is just to see if everything still looks good.

If I haven’t already done so, I’ll use this opportunity to identify categories where I may be on the verge of overspending and move money from other categories if necessary.

Here’s my step-by-step guide to create a monthly budget with a free Google Sheets template.

Your Action Plan

Following the five steps of my financial checklist can help you reach your money goals with a minimal time commitment of only 10 minutes per week.

To get into the weekly routine, pick a time to complete your checklist and set a calendar reminder.

For me, it’s Fridays at 9 a.m. I like being able to take 10 minutes to make sure my finances are in order before the weekend when I tend to spend more money.

I hope you found this weekly financial checklist helpful. Let me know what you think in the comments below!