As a personal finance writer, I’ve published plenty of articles about how to increase your credit score.

But what I’ve learned over the years is that building an excellent credit score isn’t really as complicated as some experts say.

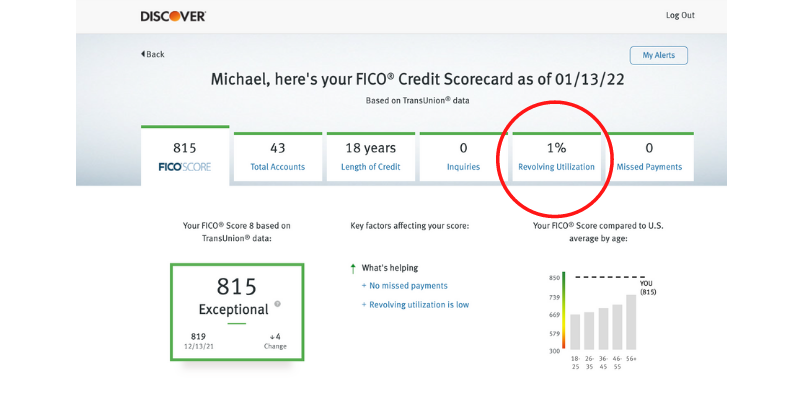

And I have an 800 credit score to prove it:

In this article, I’ll retrace my 18 years of credit history to tell you exactly how I got to this point.

Keep reading or watch the featured video above if you want an excellent credit score to obtain better interest rates on a mortgage, auto loan and credit cards.

The Big Picture

FICO scores are a specific brand of credit score used by lenders.

Anything over 800 is considered exceptional, while anything over 740 is very good. Either will be enough to obtain favorable interest rates. There’s no need to aim for a perfect 850.

According to FICO’s website, there are five main factors that contribute to your credit score:

- Payment history: 35% of score

- Amounts owed: 30% of score

- Length of credit history: 15% of score

- Credit mix: 10% of score

- New credit: 10% of score

I’m going to review each of these five factors and explain what I did to improve my credit score. These are tips that you can apply as well. Let’s get started!

Payment History: 35% of Score

Payment history is the most important factor in determing your credit score.

Lenders want to be confident that if they loan you money, you’ll pay them back. The best way to demonstrate to the lenders that you’re trustworthy is to pay your bills on time.

I went through my free Experian credit report from AnnualCreditReport.com and it said “Never late” next to every account.

Never missing a payment is ideal because Forbes reports that “once a late payment is listed on your credit report, it can seriously damage your credit score.”

If you’ve already missed a payment or two, don’t be discouraged. Start paying on time to reverse some of the damage.

Thanks to technology, it’s easier than ever to avoid late payments:

- Make a note on your digital calendar

- Activate text or email payment reminders with your lenders

- Consider setting up auto pay

Personally, I don’t put credit card bills on auto pay because I prefer to review my transactions for errors before paying. Learn more here.

Amounts Owed: 30% of Score

To explain amounts owed, let me tell you about the first credit card I ever had. It was a Discover card for students. I applied for it 18 years ago while in college.

The credit limit was very low, so I used this card for small purchases and paid them off in full — never maxing out the card.

Here’s a screenshot from my free Discover Scorecard. As you can see, I have an extremely low credit utilization rate and only use 1% of my total available credit limit.

That may not be realistic for everyone, but using a low percentage of your available credit will help your score.

Experian says the average utilization rate is 11.5% for people with FICO scores of 800.

Here’s a bonus tip: Instead of paying my bills once a month, I log in to my credit card accounts every week to pay all of my bills in full. This weekly habit keeps my credit utilization rate low.

If you can’t pay off the total balance weekly, try to avoid carrying a balance from month-to-month.

Length of Credit History: 15% of Score

You may think that there’s nothing you can do about the length of your credit history, but hear me out on this one.

My length of credit history is 18 years. I opened my first credit card account when I was a teenager after hearing it was a good idea to establish credit early on.

For those just starting out, student and secured credit cards are two solid options to build your credit.

In addition to the age of your oldest credit account, FICO also takes into consideration the age of your newest credit account and the average of all credit accounts.

That’s why credit experts say you should keep credit cards active and avoid closing old accounts.

The thinking here is that if you cancel a credit card, it will lower the average for all of your credit accounts. That action alone could result in a credit score drop.

I took this advice very seriously until I got my credit score to the exceptional range — above 800.

However, I’ve stopped worrying so much about the impact of closing an old credit card. And if I’m not getting value out of a card with an annual fee, I’ll cancel it.

This hasn’t impacted my credit score much, but I probably wouldn’t risk it if I had a lower score.

Credit Mix: 10% of Score

Having a good mix of credit accounts can put you on the path to an 800 score.

I remember starting with that Discover card 18 years ago. It was my only credit card for about 18 months until I opened an American Express card.

In the years that followed, I gradually opened more credit cards to earn cash back rewards — and this added to my credit mix.

But as Education Loan Finance reports: “You want to have a diverse mix of credit accounts. So it’s better to have a credit card, mortgage and auto loan rather than three credit cards.”

I’m not suggesting that you take out a loan just to build credit. It will happen naturally as you move through life.

For example, here’s my credit history timeline:

- First 5 years: Credit cards only

- Year 6: First mortgage

- Year 8: First car loan

This is important: When I took out my first home loan in 2009, my credit score was not above 800. It was in the mid-700s, but I still locked in a great interest rate.

That’s a real-life example of why you should not obsess over the number 800!

New Credit: 10% of Score

If you’re trying to improve your credit mix, you may think about opening several new credit cards at once. But that’s probably not a good idea.

Instead, you want to space those credit inquiries out.

FICO’s website says that opening several new credit accounts in a short period of time “represents greater risk, especially if you don’t have a long credit history.”

Although my total number of accounts is high at 43, that’s from 18 years of credit history.

I never applied for multiple credit cards or other loans at once. So if you’re applying for a mortgage, don’t get an auto loan or a new credit card around the same time.

This type of activity could send red flags to the bank about approving your mortgage.

Key Takeaways

As someone who has had an 800 credit score for years, here are my five main takeaways to build an excellent credit score:

- Pay your bills on time and in full if you can

- Keep your credit utilization rate low – do not max out your credit cards

- Use your credit cards regularly and try not to close old accounts

- Mix it up: Diversify your types of credit accounts

- Avoid opening too many accounts in a short period of time

Remember my bonus tip: To work on lowering your credit utilization rate, try paying off your bills in full every week or twice a month -– instead of just monthly.

After you’ve tested this method out for a few months, see if your credit score has increased.

It’s important to check your credit reports and scores regularly. I use Discover Scorecard for my credit scores and AnnualCreditReport.com for credit reports. Both are free!

For more money-saving content, subscribe to Michael Saves and Michael Saves Plus on YouTube!