How would you like an extra $1,000 a year in your bank account? A new credit card rewards trick that I’m testing out can help you stash away more money with little effort.

If you pay off your credit cards in full every month like me, I think you’re going to really like the strategy I’m about to outline.

RELATED: 9 ways to lower your bills and save money every month

Use my simple credit card rewards strategy to save extra money

First, let’s talk about credit cards in general. Most financial experts would say that I have too many of them — 12 cards — but my credit score is over 800 because I’m a responsible credit card user.

I only carry a few cards in my wallet and swap them out depending on what I’m planning to buy.

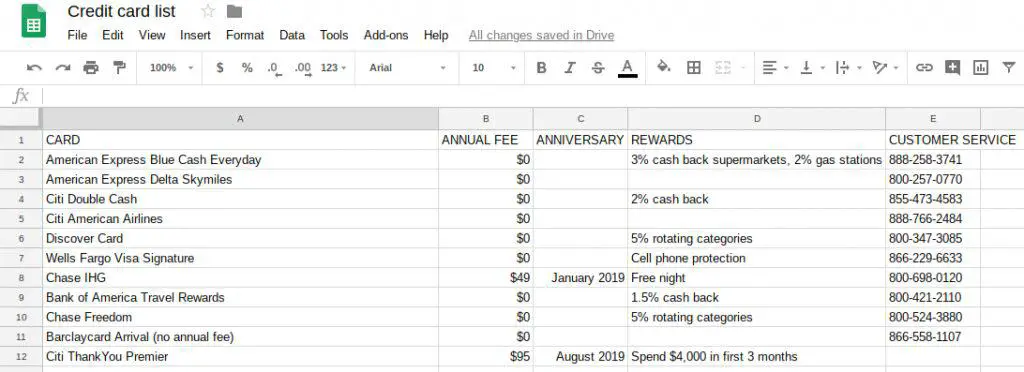

To stay organized, I maintain a credit card list in Google Sheets. The spreadsheet lists the name of the card, rewards details, annual fee, anniversary date and the number for customer service in case it’s ever lost or stolen.

Overview of my credit card rewards strategy

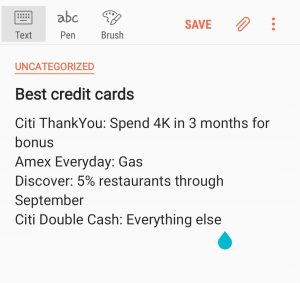

Different credit cards serve different purposes in my life. I pay for my $12/month cell phone plan with a Wells Fargo card that offers cell phone protection, use Discover and Chase Freedom based on the rotating 5% categories, and put many other purchases on my Citi Double Cash to get 2% cash back.

I’m currently taking advantage of a sign-up bonus for the Citi ThankYou Premier card, so most purchases are going on that card for the next few months.

When I talk to people about credit cards rewards, I’m amazed at how some people have several cards but don’t know how to maximize their rewards. I always recommend that they review the rewards structure and redemption options to form a personal strategy.

For example, some cards provide better value if you redeem points/miles for travel rather than cash or gift cards. Get the most out of your cards!

If you have trouble remembering the best credit card to use for specific purchases like groceries, gas or department stores, write down a note and keep it in your wallet to remind yourself.

You can also maintain a list like the one below using a note-taking app on your smartphone:

Now to my simple trick that can save you money…

Now that I’ve described my general credit card rewards strategy, let’s move on to the money-saving trick that I’ve started to apply.

When I go to redeem my credit rewards for free travel, statement credit, cash back or gift cards, I match the value of the reward and transfer that amount to an online savings account with a high interest rate.

- Book a $200 flight with credit card points? Put $200 in your savings account!

- Earn a $500 credit card sign-up bonus? Put $500 in your savings account!

- Redeem $100 in points for a statement credit? Put $100 in your savings account!

With this credit card trick, your savings account balance will grow as you earn more credit card rewards!

Think about it this way: Most people redeem credit card points and miles to spend more money, but matching the reward value and putting that money in the bank will help you stay focused on saving for your future.

I’ve already got $163 in my new CIT Bank account, which I set up just for this challenge. Separate goals = Separate bank accounts!

RELATED: How I’m using 5 bank accounts to save more money

My goal is to match my credit card rewards for six months and then transfer the balance to my Roth IRA where it can earn money over time and help me reach financial freedom.

Now that’s turning credit card rewards into a reward that will last a lifetime! Who’s up for the challenge?