Featured

Deal Alerts for April 2024

Is T-Mobile Home Internet Worth It? 4 Things to Know Before You Sign Up

I’ve tested T-Mobile’s 5G home internet service two times since it launched. Here’s what you need to know before signing up!

Are Comcast’s NOW Internet and Phone Plans Worth It?

Comcast is launching new internet and phone plans that could save you money. Here’s what I’ve learned about NOW Internet and NOW Mobile.

Deal Alerts for April 2024

Here are my favorite limited-time deals on streaming services and devices, cheap phone plans and internet plans.

YouTube TV Tips and Tricks: 20+ Settings You Need to Know

If you have YouTube TV, you’re going to wish that you knew about these features sooner! Here’s how to customize the live TV service.

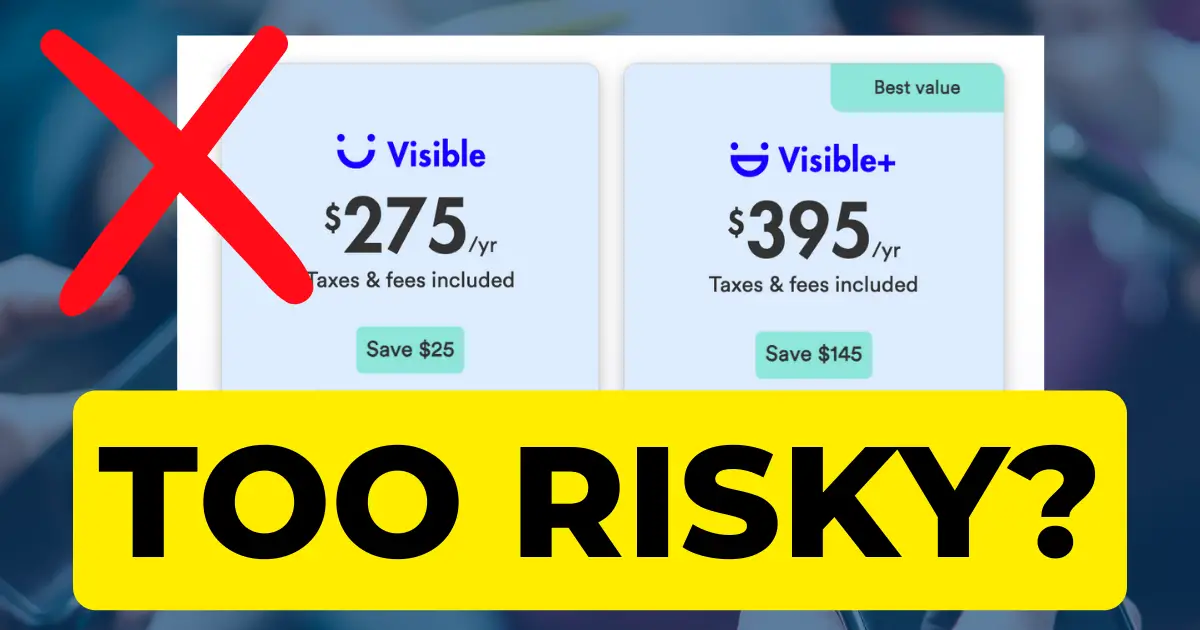

Are Discount Annual Phone Plans Worth the Risk to Save Money?

Prepaid annual plans are not for me, but they could save you money. Here’s how to decide if you should get one!

Visible Wireless Review: 9 Things to Know Before You Sign Up

Verizon-owned Visible continues to offer one of the best deals in wireless after making big changes to its plans. Here are the pros and cons!

WATCH MICHAEL SAVES ON YOUTUBE

HOW MICHAEL SAVES

- Visible by Verizon: Visible has been my primary wireless service since 2019. For $25 per month, I get unlimited talk, text and data on Verizon’s network.

- YouTube TV: I subscribe to YouTube TV for about six months out of the year. This service offers 100+ cable channels and local stations for $72.99 monthly.

- Verizon Home Internet: I dropped fiber internet service and switched to 5G home internet from Verizon. It offers unlimited high-speed data for only $50 a month.

Follow MichaelSavesDeals.com for limited-time offers on the services that I recommend.

NEW COMPARISON TOOL: Enter your address to see available internet plans where you live. Need help? See my internet plans guide or email michael@michaelsaves.com for a personal recommendation.

WHY YOU CAN TRUST MICHAEL SAVES: Every single article on MichaelSaves.com is based on my personal experience and hands-on testing, not internet research alone. In addition, none of my content is sponsored. No company has ever paid me for coverage or a favorable review. My work is supported through display ads and affiliate links. Learn more about the Michael Saves Difference here.