If you signed up for a streaming service like YouTube TV, you might be surprised to see a higher than advertised price on your bill. One explanation may be taxes.

In this article, I’ll help you determine the cost of YouTube TV after taxes and fees. Let’s get started!

Taxes on YouTube TV: What You Need to Know

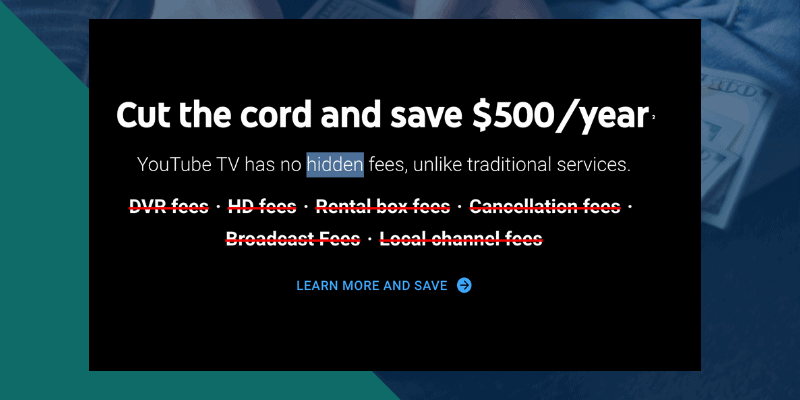

One of YouTube TV’s selling points is that it doesn’t have many of the fees that traditional cable or satellite TV services are known for. That fact is front and center on YouTube TV’s website:

No DVR fees, HD fees, rental box fees, cancellation fees, broadcast fees and local channel fees.

However, there is one fee that may be unavoidable for some YouTube TV subscribers. Depending on where you live, a sales or communications tax may be added to your bill.

According to a February 2020 article from CNBC, about half of U.S. states have started to tax streaming subscriptions like YouTube TV, Hulu, Sling TV, Netflix, Disney+, HBO Max and more.

How Much Does YouTube TV Cost After Taxes? Here’s How to Find Out!

One of those states is Florida, where YouTube TV subscribers must pay a communications services tax.

As of this writing, the Florida communications services tax rate is 7.44%. But on top of that, a local communications services tax is added to the bill. It varies by location.

For example, I pay the state tax of 7.44% and a local tax of 5.72%, for a total of 13.16% in streaming TV taxes.

Streaming Tax in Florida Example

- Florida communications services tax: 7.44%

- Local communications services tax: 5.72%

- Total communications services tax: 13.16%

The tax rate is based on the address that you provide to a streaming TV provider. I entered my ZIP code on YouTube TV’s website to preview the total price, including taxes, before I signed up.

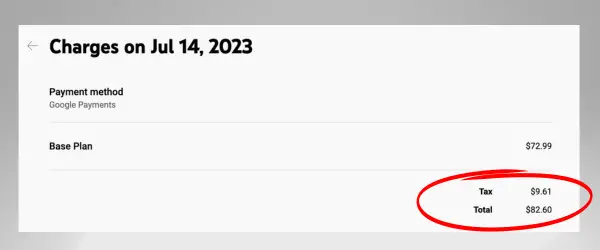

YouTube TV’s regular monthly price is $72.99, but it’s $82.60 after $9.61 in taxes.

These taxes can really add up, especially if you subscribe to multiple streaming TV services. For YouTube TV alone, this $9.61 per month tax works out to $115.32 per year.

And to be clear, not every state taxes streaming TV services like YouTube TV. You have to do some homework.

If you’re not sure whether a sales or communications tax is added to streaming services where you live, your first stop is your state’s revenue department. The IRS has links to them all here.

You can also do what I did and go through the checkout process to preview the price with taxes included.

Finally, remember that this isn’t just about YouTube TV. If your state taxes one streaming service, it’ll tax the others. But choosing cheaper streaming options will obviously mean a lower tax burden.