Since the days when I was working to pay off my $86,000 mortgage in two years, I’ve used multiple bank accounts to stay focused on my goals and maximize my savings rate.

Most people probably have one checking and one savings account — but I’ve had four total accounts until about a year ago.

RELATED: Google Sheets budget template: Free, simple and easy to customize

Use multiple bank accounts to save more money

Let me give you a brief overview of the strategy that I’ve used for years, but keep reading to find out why I decided to switch things up — and how it’s already paying off in a big way!

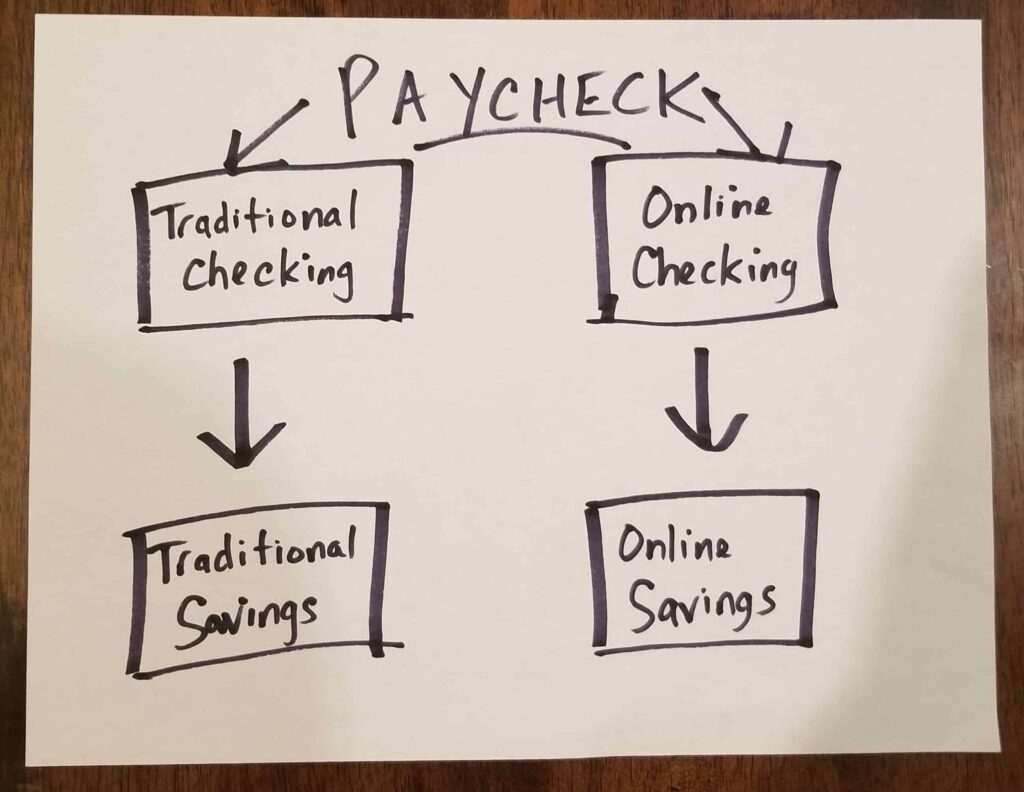

I drew this picture to illustrate the four bank account system that I implemented during my mortgage payoff:

Each bank account has a purpose

My paycheck was split between two checking accounts (one with a traditional bank and the other with an online bank), then I manually transferred funds to two savings accounts.

- Traditional checking = Fixed expenses like the mortgage, insurance and utility bills

- Online checking = Variable expenses like groceries, clothing and entertainment

- Traditional savings = Rainy day fund of roughly $1,000

- Online savings = Emergency fund of 3-6 months of living expenses

Separating variable expenses from fixed costs really helped me control impulse buys. If my online checking account balance got too low, I knew I had to log in to my Personal Capital account and review my spending carefully. This setup also enabled me to keep most of my money in an online bank with a high interest rate and no fees.

The new way…

Starting in early 2018, I abandoned the system that worked so well for me after my traditional bank made an error that motivated me to say goodbye to the “big bank” once and for all.

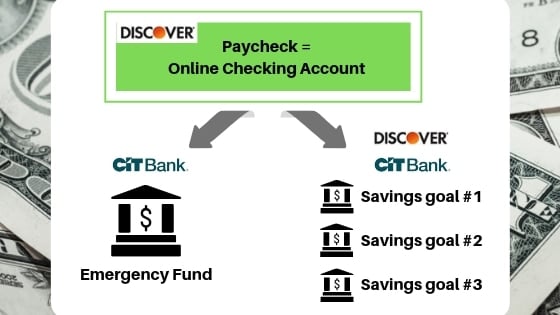

I used the opportunity to restructure my personal money plan and go 100% online. Here’s what I came up with:

My paycheck now goes to one checking account, which I have with Discover Bank. I then transfer money either weekly or monthly to three savings accounts with Discover and CIT Bank for short-term goals. I created these three savings accounts for separate money challenges.

If you’re keeping track, that’s a total of four bank accounts. The fifth account is my emergency fund that’s designated for 3-6 months of living expenses. I now keep it with CIT Bank, an online bank with a great interest rate! I opened this account with a different bank than my checking account to reduce the temptation to make any withdrawals.

The other reason I have an account with CIT Bank is the interest rate! Its Savings Builder account is a great fit for someone trying to grow an emergency fund. If you maintain a $25,000 balance (hard) or make at least one single deposit of $100 a month or more (much easier), you earn 1.25% APY. That rate is effective as of May 2020.

Can’t commit to saving regularly? This account probably isn’t for you. The interest rate on the Savings Builder account drops below many other online banks if you don’t meet the requirements that I just outlined.

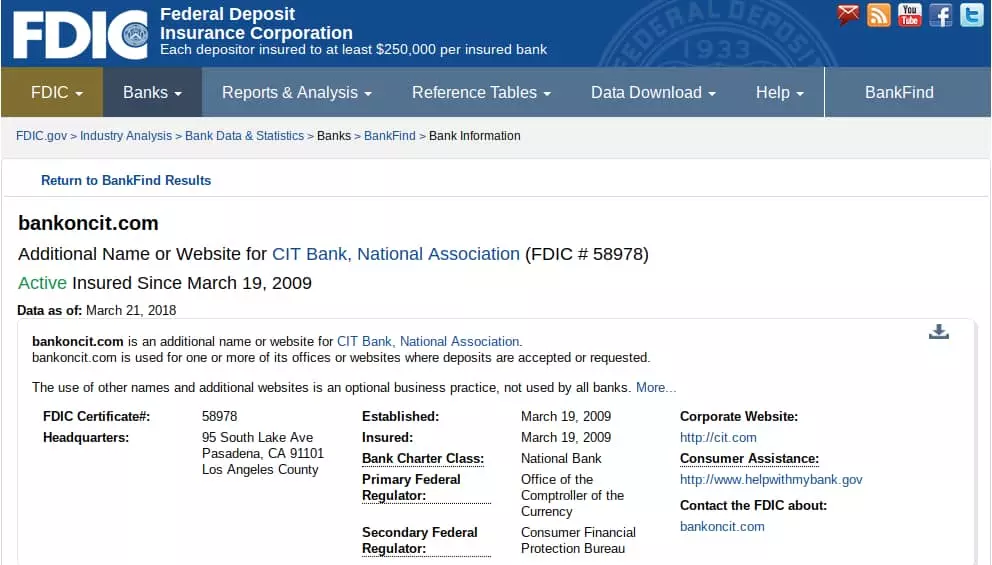

Is your bank account FDIC insured? Here’s how to tell

My two online banks, CIT and Discover, are both FDIC-insured institutions. That’s something you need to look for. When you’re researching banks online, go to FDIC.gov and enter the bank’s name, FDIC number or website address to verify that it’s an FDIC-insured bank.

For example, here’s the results page after I typed in CIT Bank’s URL:

Move your money to an online bank!

Interest rates for savings accounts at online banks are around 1.50% as of May 2020. Many online banks have low opening deposit requirements and no minimum daily balances or maintenance fees.

I saved an extra $5,000 last year by switching to my new system that focuses on those short-term challenges.

My money plan may not work for everyone, but I hope that it inspires you to sit down and think about how you can create a personal strategy to reach your financial goals faster.

At the very least, put your money in an online bank and start earning interest on your savings today!

Hey there! Thank you for sharing your strategies. My credit is frozen. Will I have to thaw it to open an account with CIT or other online bank?

My credit is frozen and I was able to open an account!

I don’t understand the credit card rewards system you are using? I don’t know how that really helps. I pay my credit card off every month and spend the reward points on a once or twice a year vacation to pay for the hotel. I have never been disappointed with my stays. Is this just another way to save money? I already save $850 a month and can’t afford to save anymore. And I also have two savings accounts traditional and on-line. Love the higher rate the on-line is paying and that is my long term savings. So what else can I do to increase rewards or money. Thanks

Hi Michael – I really like your blog and youtube videos. I found the Mortgage, Southwest tips and Xfinity mobile really helpful.

FYI – I have a couple of tips that have worked for me that you may want to check out. For savings I use a High Yield Muncipal Mutual Fund. Although it says high yield, muncipal high yield and corporate high yield are two different things. Municipal high yield isn’t junk bonds, it is toll roads bridges, water utilities etc. so not very risky and it has a stable NAV price and pays ~36 to 45 dollars a month. You can have the money ACH’d to your checking account at any time. There is an initial sales load for A shares, and none for C shares. The fund that I use is currently on limited offering, but, when it opens back up you may want to check it out. Once you are in the fund you can add at any time even if it is on limited offering. Also, if you live in a zero income tax state, there are no taxes other than capital gains.

Disclaimer: I do work for them in operations, not sales, but I think this is a great deal and would do this even if I didn’t work for them. I stumbled on this by accident.

https://www.invesco.com/us/financial-products/mutual-funds/product-detail?fundId=30547

Hi Michael – the second tip my brother clued me on when I went home to Michigan for the holidays, and it is Lake Michigan credit union’s checking account. https://www.lmcu.org/personal/banking/checking-accounts/max-checking/

It pays out 3.00% APY year.

Please keep posting videos, as I find them really intelligent and useful.

FYI – the 36 to 45 dollars a month is based on a 10,000 deposit or investment. if more or less is put in the figure would go up or done