Discover Bank is well known for its cash back credit cards with no annual fees, but the company also offers arguably the best free checking account in America.

Three highlights of this account are no account fees, cash back on debit card purchases and free standard checks.

Discover Bank Checking Account Review Summary: Pros and Cons

| Pros | Cons |

| 1% cash back on debit card purchases | No physical branches |

| Free standard checks | Can’t deposit cash, even at partner ATMs |

| No account fees | $510 daily ATM withdrawal limit |

| 60,000+ surcharge-free ATMs | Harder to withdraw cash outside the U.S. |

| Simple to use mobile app and website |

I’ve had a checking account with Discover Bank since 2014. More recently, I opened 10 online checking accounts (including a second with Discover) to evaluate the best options for free checking right now.

Discover remains a top contender, but is this the right checking account for you? Let me help you decide.

Table of Contents:

- Cash Back Rewards

- Free Checks

- Account Fees

- Nationwide ATM Access

- Deposits and Withdrawals

- App and Website Experience

- Customer Service

Cash Back Rewards

Officially named Discover Cashback Debit, this checking account features 1% cash back on up to $3,000 in purchases every month. That’s a maximum of $30 a month or $360 a year.

This is a valuable perk from Discover. Most checking accounts don’t offer any cash back and pay little or no interest.

You can use your Discover debit card wherever you see the Discover symbol. But keep in mind that some stores only take debit or credit cards with a Visa or Mastercard logo.

Personally, I put most purchases on a credit card so that I can earn more than 1% cash back. But if you’re in credit card debt or just prefer debit, Discover’s offer is hard to beat.

After you’ve earned cash back, you can collect it whenever you want. Discover has no minimum redemption amount.

Free Checks

If you write checks frequently or even just occasionally, you can save money by switching to an online bank like Discover that offers them free upon request.

With Discover, you can order and reorder free personal checks in batches of 100. Shipping is also free.

Quite a few online banks have eliminated paper checks, others will mail a check on your behalf and some will charge a small fee for a batch of checks. Few banks still provide truly free personal checks.

If you don’t request checks from Discover, you won’t get them. If you find that you need a check, they’ll mail a check for you at no charge if you contact customer service.

Account Fees

Discover Bank does not charge checking customers a monthly maintenance fee like most traditional banks.

If you’ve been hit with any type of bank fee from your current bank, consider moving your money to an online bank. Discover and other online banks typically don’t have minimum balance requirements.

In addition, Discover won’t even charge for insufficient funds or stop payment orders. That’s very rare.

Discover’s No-Fee List

- Monthly maintenance

- Withdrawals at partner ATMs

- Replacement debit card

- Standard checks

- Official bank check

- Online bill pay

- Expedited delivery for debit card replacement

- Expedited delivery for official bank checks

- Deposited item returned

- Stop payment order

- Insufficient funds

- Account closure

Discover will charge $30 for an outgoing wire transfer. This isn’t a feature that most customers will use often. I only requested a wire transfer from Discover during the homebuying process.

Also, using ATMs outside of the Discover partner networks may result in fees. More on that next.

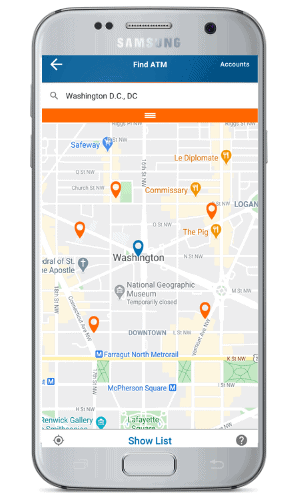

Nationwide ATM Access

If you use your Discover debit card to withdraw cash at more than 60,000 participating ATMs, you won’t have to pay any fees. Discover partners with the Allpoint and MoneyPass networks.

There has always been a no-fee ATM within walking distance from my home at places like CVS, Target, Walgreens and Walmart.

If you withdraw cash from an ATM regularly, check Discover’s website before you sign up for an account to see if there are no-fee ATMs where you live, work and travel.

Here’s a link to the tool. Existing customers can search for nearby ATMs using the mobile app.

To be clear, Discover will never charge you to use your debit card at an ATM. However, owners of out-of-network ATMs do charge fees and Discover won’t reimburse you. That’s why you want to stay in-network.

For international travelers, withdrawing cash may be more difficult. I’ve been unable to use my Discover debit card in Europe because Discover cards aren’t widely accepted overseas.

If you frequently use ATMs outside of North America, this may not be the best checking account for you.

Deposits and Withdrawals

Deposits at Discover Bank are FDIC insured, just like regular banks. This protects your insured deposits in the unlikely event that a bank fails.

Here’s how to move money in and out of a Discover checking account:

Deposits

There are several ways to fund your Discover checking account: direct deposit, online transfers from another bank, mobile check deposit and mailing a check.

Unfortunately, there’s no easy way to deposit cash. Discover Bank has no branches and ATM cash deposits aren’t allowed.

There are a couple of workarounds if you need to deposit cash. You can get a cashier’s check from an in-person bank or credit union for a small fee and then use Discover’s mobile check deposit feature from the app.

The second option is to buy a money order and mail it to Discover. You can’t upload a money order using the app.

Withdrawals

To withdraw money from your Discover checking account, use an ATM, request cash back when paying with debit, transfer money to an external account, use bill pay, write a check or pay for a wire transfer.

When you need cash, one downside is Discover’s relatively low daily ATM withdrawal limit of $510. The limit cannot be raised, even temporarily.

I know from experience that the daily ATM withdrawal limit resets at midnight. So if you need $1,000 in cash, you could take out $500 at 11:58 p.m. and then another $500 at 12:01 a.m.

Some ATMs have lower withdrawal limits, so you may need to visit multiple ATMs to get up to $510 per day.

App and Website Experience

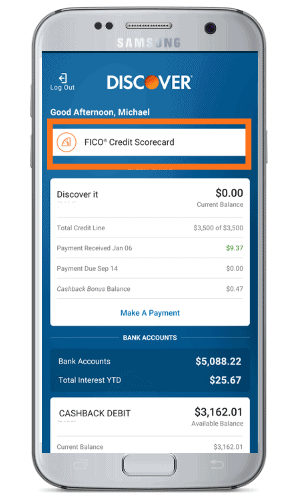

Discover Bank’s app and website are both user friendly. In addition to my two checking accounts with Discover, I have savings accounts and a credit card that I manage from the same login.

If you’re not great about remembering usernames and passwords, you can use your fingerprint to log in to the app.

The app is my preferred way to check balances, transfer money, deposit a check, pay bills and redeem cash back. I use the website when I need to download statements and tax documents.

Perhaps my favorite feature is Discover’s FICO Credit Scorecard, and it’s front and center.

The FICO Credit Scorecard is the first thing that you see when you open the app. It’s a great way to track changes to your credit score over time.

Overall, Discover’s app and website really shine. Both experiences are simple and easy to navigate.

Customer Service

Although Discover Bank doesn’t have physical branches, it provides 24/7 customer support over the phone and by chat. When I’ve called, the U.S-based agents have been friendly and helpful.

Since Discover is an online bank, the only way to open a checking account is at Discover.com.

When I opened a second Discover checking account to document the signup process, I noted that it took only about five minutes. My debit card and checks arrived separately about a week later.

The customer service representatives are very knowledgeable about the Cashback Debit Account, including some of the limitations that I’ve outlined in this review.

If you have questions before signing up, call them and test drive the customer service. The number is 1-800-347-7000.

Final Thoughts

The Discover Cashback Debit Account helped me easily transition from a checking account with a traditional bank to an online bank. Here’s who I think Discover’s checking account is best for:

- Someone who gets paid through direct deposit and doesn’t need to deposit cash

- Those who don’t like to use credit cards but still want to earn rewards for debit card purchases

- Anyone who doesn’t want to pay an account maintenance fee or other bank fees

- People who want a checking account that offers free paper checks

If Discover’s checking account isn’t right for you, Capital One Bank and Ally Bank may be better alternatives.

Capital One Bank offers a lot of the same perks as Discover, but it also lets customers deposit cash from select Capital One ATMs across the country.

Meanwhile, Ally Bank reimburses customers for out-of-network ATM fees up to $10 per statement cycle.

Overall, I believe the Discover Cashback Debit Account is worth considering for its fee-free banking, debit card rewards, access to ATMs, free checks and a great mobile app.

Do you have a checking account with Discover Bank? Add your customer review in the comments below!

Limit can be raised with an easy phone call fyi

The mobile deposit of a cashier’s check is an interesting idea of how to deposit cash to my Discover bank account. I will have to try this and see how well it works.