When I was 27 years old, I paid off the mortgage on my Atlanta condo just two years after I bought it and became 100% debt-free.

If you want to pay off your mortgage or any other debt faster, I’m here to help!

In this article, I’ll share the six steps to paying off a mortgage early. No, this isn’t some complicated HELOC strategy. It’s a simple plan that you can start following today.

I hope that sharing my story will inspire you to get out of debt, whether it’s a mortgage, student loan or credit cards.

6 Steps to Pay Off a Mortgage Faster

- Buy a home that you can afford

- Consider a 15-year mortgage

- Set a mortgage payoff date

- Automate your extra payments

- Increase income and reduce expenses

- Reward your success

Important note: As you read through the details of my personal story, try to remain focused on how you can apply the six steps to reach YOUR goals.

Don’t get stuck on the specifics of my life: loan amount, salary, relationship status, etc.

The fact is that I paid off an $86,000 debt in two years. That’s a lot of money! And even if your mortgage is double or triple mine, the same strategy will work.

Now let’s get right to the six steps to paying off a mortgage faster…

1. Buy a home that you can afford

The first step to paying off a mortgage early is to buy a home below your budget.

When you go through the mortgage pre-approval process, the bank provides you with an estimate of a loan amount you’ll likely be able to get.

Don’t let the bank set your budget! You know your finances better than them.

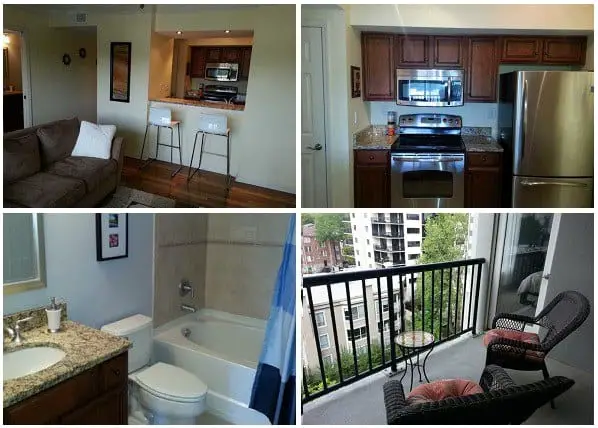

I purchased my condo in October 2010. The bank pre-approved me for a $250,000 loan, but I reviewed my budget and wasn’t comfortable with that number.

My real estate agent showed me properties on the market for $200,000 or less.

Remember, there was a housing crisis at the time. I ended up getting an incredible deal and bought a 765-square-foot condo for $107,000.

I just checked the other day, and the condo is now valued at around $240,000.

Although you won’t find $107,000 condos in many places anymore, my advice stands: Stay within your budget to avoid being “house poor.”

2. Consider a 15-year mortgage

If you can find a home below your budget, step two becomes a lot easier.

My grandmother always suggested a 15-year fixed-rate mortgage because the interest rate is lower than a 30-year mortgage.

But the disadvantage of a 15-year loan is that the monthly payments will be higher.

NerdWallet has a great calculator on its website to compare both types of mortgages. Here’s an example of the difference in monthly payments:

- Home price: $200,000

- Down payment: $40,000 (20%)

- Interest rates:

- 15-year loan: 3.4%

- 30-year loan: 4.1%

| 15-year loan summary | 30-year loan summary | |

| Monthly payment (principal, interest) | $1,136 | $773 |

| Total cost (down payment, principal, interest) | $244,475 | $318,323 |

As you can see in the NerdWallet example above, a 15-year mortgage is better for your wallet.

If you already have a 30-year conventional loan, you can still prepay your mortgage. Just contact your loan provider first to make sure there’s no prepayment penalty.

3. Set a mortgage payoff date

The third step in the process is to set an achievable goal — your mortgage payoff date.

My initial goal was to pay off my mortgage by my 30th birthday, which was less than five years from the date that I moved in.

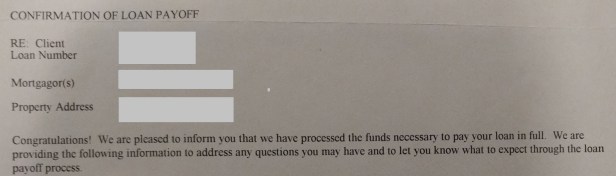

As I mentioned earlier, I ended up eliminating the mortgage two years and two months later.

How did I come up with that initial goal? I first reviewed my personal budget and calculated the monthly surplus that I could potentially put toward the mortgage principal.

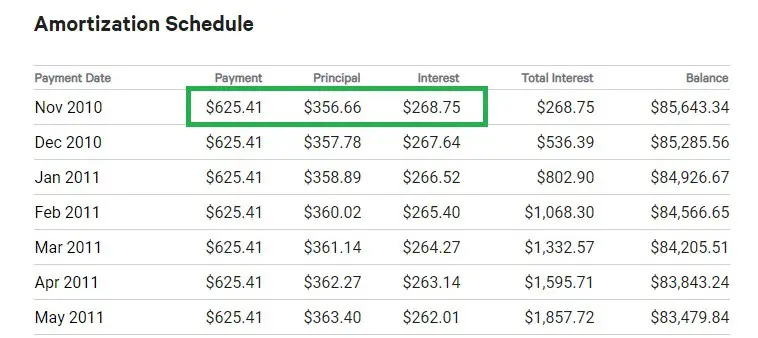

Then, I consulted the amortization schedule that was included in my loan closing packet.

An amortization schedule shows how much of every monthly payment goes toward interest and how much goes toward the principal — and it’s shocking at first.

For example, $268.75 of my first $625.41 mortgage payment went to interest:

The amortization schedule helped me realize how making additional principal payments could reduce the interest I paid over time and the length of my loan.

If you don’t have your amortization schedule handy, no worries. You can create one online.

Once you’ve plugged your numbers into Bankrate’s amortization schedule calculator, you can calculate how extra payments will impact your payoff date.

Here’s an example…

Let’s say that you have a $160,000 mortgage balance, a 30-year fixed-rate loan and an interest rate of 4.5%.

Your monthly payment is $810.70, according to Bankrate’s calculator.

For a 30-year loan starting in February 2019, you can make regular payments and pay off the home in February 2049 — 30 years later.

But what happens if you add extra payments? That’s where things get interesting.

If you apply an extra $100 to your monthly mortgage payment ($910.70 instead of $810.70), you’ll pay off the home in February 2043.

Bump it up to $500? The mortgage will be gone in October 2032.

Can you find an extra $1,000 a month to prepay your mortgage? That will change your payoff date to February 2028 — less than 10 years from the closing date.

- Mortgage amount: $160,000

- Term: 30 years

- Interest rate: 4.5%

- Start date: February 2019

| Monthly payment | Extra monthly payment amount | Payoff date |

| $810.70 | $0 | February 2049 |

| $910.70 | $100 | February 2043 |

| $1,310.70 | $500 | October 2032 |

| $1,810.70 | $1,000 | February 2028 |

Action item: After looking at your budget, use Bankrate’s amortization schedule calculator to set an initial mortgage payoff date that’s realistic.

You can always refer back to the chart and make adjustments along the way.

4. Automate your extra payments

Once you’ve played around with the amortization schedule calculator and set your goal, step four is to automate your extra payments with your bank.

This is simple: Just set up a recurring transfer from your checking account to your lender.

You may also want to pay your mortgage biweekly if your loan provider offers this option at no additional charge. Some do and others don’t.

Here’s how it works…

With a biweekly payment option, you pay half of your monthly mortgage amount every two weeks, which works out to 13 monthly payments a year instead of 12.

Bankrate has another calculator to show you the interest savings with this method:

In addition to setting up automatic payments, I also made one-time transfers whenever I had extra money to prepay the mortgage — like a tax refund.

Again, just check with your loan provider to make sure there’s no prepayment penalty.

5. Increase income and reduce expenses

Step five is the most important part of the process. I wouldn’t have paid off my mortgage in two years if I hadn’t taken drastic steps to increase my income and reduce expenses.

If you focus on making more money and spending less money, you’ll reach your goal faster.

Make more money

Let’s start with increasing income: During my mortgage payoff, I worked a full-time job and was promoted twice. My salary averaged around $70,000.

I was earning enough to pay off my mortgage in five or seven years — but certainly not two.

Once I got started and saw the mortgage principal balance drop every month, I got addicted to saving as much money as I could. (I also set money aside for retirement.)

That’s when I set a goal to work an extra 10 hours a week on top of my full-time job.

I primarily earned more money by freelancing in a separate department at my full-time employer, waiting tables for private functions and pet sitting.

There were some months that I was able to live off my side hustles alone.

I paid off my mortgage back in December 2012. Since then, there are now more ways to earn extra money on the side with a lot less effort.

These money-making strategies are great for singles and those who have families:

- Use cash back apps for your grocery shopping

- Maximize credit card rewards

- Switch to an online bank with a top interest rate

Lastly, I put any extra income toward my mortgage payoff, including tax refunds, work bonuses, birthday cash and money earned from selling items on eBay and Craigslist.

Save more money

Reducing your expenses is another way to find more money to apply to your mortgage principal.

Early in my mortgage payoff journey, I embraced a minimalist approach to my life and realized that I had been buying a lot of “stuff” that I really didn’t need or want that badly.

Here’s the test…

- Do I need this item?

- Will this item make me happy?

- Can I afford this item?

If I answered “no” to all three of those questions, I didn’t make the purchase. It’s that simple.

Action item: Go through last month’s statements and think about your purchases. How would you answer the questions in my test for those items?

While you’re going through your statements, review your budget categories one-by-one (food, entertainment, clothing, etc.) and look for ways to save.

Here are just a few of the ways that I reduced my expenses:

- Cut the cord: I broke up with the cable TV company long before live streaming TV services existed and used a digital antenna for free entertainment.

- Restaurant rule: I set a rule to only eat out when it was a social experience with my family and friends. No more trips to the drive-thru!

- Switch cell phone plans: My cell phone bill is $25/month with Verizon-owned Visible. Unlimited talk, text and data.

- Compare auto insurance: Pick a few of the major auto insurers and see if you can find the same coverage for a cheaper price.

Learn about more ways to lower your bills here!

If you don’t already have a budget in place, I recommend Google Sheets. It’s a free tool that you can use on both desktop and mobile to track your expenses.

I also use Mint and Empower, which has an excellent free retirement planner.

6. Reward your success

The sixth and final step is to reward your success as you make progress toward your goal.

Paying off a mortgage early is a long-term goal. It may take you five, seven or even 10 years to reach it, so you have to stay motivated along the way.

For example, I gave myself $100 in “play money” for every $5,000 that I paid off the mortgage.

Set a series of short-term goals and reward yourself when you reach them. It will make the loan repayment process a lot more fun!

And once I paid off my mortgage, I celebrated with a trip to Aruba the next month. If you haven’t been, I highly recommend it.

Vacations are great, but the best thing about paying off a mortgage is the sense of freedom that you get from being completely debt-free.

Although I ended up selling my condo in 2014 to upgrade to a new one, I would do it all over again.

Recap: My key takeaways

Are you ready to get started? If you want to pay off your mortgage faster, let’s review the six steps and what you can do starting today:

- Buy a home that you can afford: Review your personal budget to determine how much you want to spend on housing costs per month.

- Consider a 15-year mortgage: Should you get a 30-year or 15-year mortgage? Run a comparison with NerdWallet’s free calculator.

- Set a mortgage payoff date: Use an amortization schedule calculator to see how extra payments will reduce the life of your loan.

- Automate your extra payments: Once you determine how much you can apply toward your mortgage principal, set up a recurring automatic transfer.

- Increase income and reduce expenses: Review your budget and look for ways to make more money and save more money without sacrificing your quality of life.

- Reward your success: Set short-term goals and rewards, and plan how you’ll celebrate your big mortgage payoff!

Finally, if you’ve paid off your mortgage early or have already set a goal, leave a comment below and let me know how you’re doing so far.

For more ways to save, please consider subscribing to my new YouTube channel!

Hi – With such a fast payoff, were you benefiting in annual income taxes by having Mortgage Interest to itemize/deduct from the federal returns…? And now that the deduction is gone – if you were itemizing that annual interest, what have you done in absence of that deduction re: income tax consequences?

I was able to itemize for the years that I was paying it off. I didn’t really consider taxes when deciding to pay it off. In most cases, I wouldn’t keep a mortgage for the interest deduction. I still itemize and have a CPA since I now own a business.

If one is going to pay off a loan within 2 years, is recasting the loan after one or more lump sum payments worth it?

If you plan to pay off the home quickly, I wouldn’t bother. Will avoid the process and fees (although I’ve heard they’re not too bad.)

Dude… We literally have the same mindset. You gotta want it. I am doing exactly what you have said. Hope to have my condo paid off in 18 months to 24 months.

You can do it! Come back here in 2 years and let me know how it went.