If you’ve created a monthly budget with Google Sheets, you may be wondering how to budget for irregular expenses that come up annually or semi-annually.

That’s exactly the question that a MichaelSaves.com reader emailed me to ask:

“I am going to separate fixed expenses (mortgage, utilities, etc.) and then track variable expenses—but where do you recommend I put expenses that occur either every six months or yearly (life insurance, car registration), or infrequently/unpredictably (car repairs, pet medical expenses, home/pool repairs, etc.)? They are not monthly so not sure how to plan/track those.”

4 Steps to Budget For Irregular Expenses With Google Sheets

Whether it’s insurance, taxes or gifts, there are a number of expenses that don’t happen monthly. Without a budget, these expenses may catch you by surprise.

In this article, I’ll share four steps to work infrequent expenses into a monthly budget. Let’s get started!

1. Calculate Your Irregular Expenses

If you’ve followed my Google Sheets budgeting method, you probably already have a handle on your regular monthly expenses. Now, make a list of the irregular expenses by reviewing past statements.

After you’ve made a list, estimate how much you spend in each irregular expense category every year.

2. Divide Your Annual Expenses By 12

Once you’ve calculated your annual spending for each irregular expense separately, the second step is to add them up and divide the total by 12.

Here’s a simple example of how that may look:

| Category | Annual Spending |

| Insurance | $600 |

| Gifts | $300 |

| Taxes | $300 |

| Total | $1,200 |

In this example, the total for irregular expenses is $1,200 a year. When you divide that number by 12, you get $100. I’ll explain why that number is important in the next step.

3. Add the Amount to Your Monthly Budget

After you’ve added up the total of your irregular expenses on a yearly basis and divided it by 12, you want to incorporate that number into your monthly budget.

In the example above, you would add $100 into your monthly budget to account for the $1,200 a year for irregular expenses.

If you’re using the Google Sheets budget template, I suggest that you add this monthly amount for irregular expenses to the Fixed Expenses worksheet that I explain my step-by-step tutorial.

That way, irregular expenses (along with monthly fixed expenses) are separate from variable expenses that have a greater impact on your day-to-day spending.

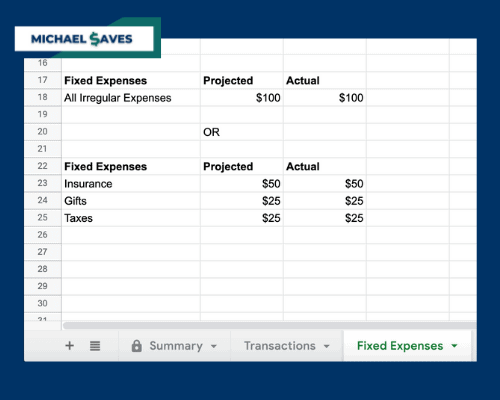

When you’re adding the monthly amount for irregular expenses, you have two choices: Create a single line for all of your irregular expenses or create multiple lines to separate them.

Which is best? That depends on how detailed you want to be with your budgeting. Here’s the difference:

The Fixed Expenses worksheet is optional. But if you don’t use a Fixed Expenses worksheet with Google Sheets, add irregular expenses to your monthly budget on the Summary tab.

4. Consider Opening an ‘Irregular Expenses’ Savings Account

Setting aside money every month for annual and semi-annual expenses will give you a better idea of your true spending. It can also help you avoid surprises when those bills arrive.

Step four is to open a separate high-interest savings account for your irregular expenses in order to stay organized.

Let’s go back to our example. You would make an automatic transfer of $100 a month from your checking account to a savings account that you opened specifically for infrequent expenses.

Before your infrequent bills are due, just transfer money from your savings to checking and pay them in full.

Of course, you don’t have to set up a separate bank account for irregular expenses. But you may be able to earn more interest by having the money in savings instead of checking.

Personally, I have multiple accounts for irregular expenses and savings goals. They help me with accountability.

But if you’re living paycheck-to-paycheck, stick with one checking account and one savings account for now. As your emergency fund grows over time, consider a separate account for irregular expenses.

Final Thought

Creating a monthly budget and logging every transaction will help control your spending, but you’re not getting the full picture if you don’t include irregular and infrequent expenses.

The four steps I’ve outlined provide a simple way to bring non-monthly expenses into your existing budget.

I believe that the more data you add to your monthly budget, the better off you’ll be. Every time you enter an expense (monthly or non-monthly), ask yourself: Is there anything I can do to lower this bill?

Over time, you’ll start to find new ways to save because you’ve put in the effort to build a better budget.

Finally, if you want to create a budget for the first time or are looking for a free budgeting tool, here’s my step-by-step tutorial to get started with the free Google Sheets budget template.

I finally decided to start holding myself accountable with my spending habits. I’ve been retired for 3 years, and have been living in somewhat the same manner as I did when employed. Thank you for clear and concise directions on using Google Sheets for budgeting. Both of my sons recommended this system.

Hi Linda. Thanks for the comment. I hope you’re enjoying retirement!