If you’re experiencing any degree of money stress in your life, it’s essential to create a bare-bones budget.

What exactly is that? A bare-bones budget is a monthly spending plan that strips out all of the luxuries. It includes all of your “needs,” but it excludes most of the “wants.”

Create a Bare-Bones Budget With Google Sheets (Quick & Easy!)

Everyone needs a bare-bones budget because life is unpredictable. Changes in job status, marital status or health status can affect your finances.

By creating this type of a budget before an emergency arises, you’ll already have a plan in place when “life happens.”

I hope that you’ll never need to use this budget, but you’ll be happy that you created one if you do.

In this article, I’ll show you how to make a bare-bones budget in about five minutes using a free template. Let’s get started…

Table of Contents:

- Open the Google Sheets Monthly Budget Template

- Determine Your Spending Categories

- Plan Your Spending for a Bare-Bones Month

1. Open the Google Sheets Monthly Budget Template

To create a bare-bones budget, I suggest that you use Google Sheets. It comes with a free monthly budget template.

This is actually the same budget spreadsheet that I use for my regular budget, but I make a few tweaks.

After you create your bare-bones budget, learn about that here.

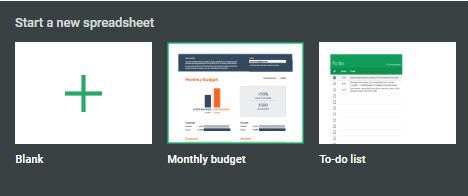

To access the budget template, open Google Sheets from a computer and look for the “Monthly Budget” spreadsheet at the top of the screen.

2. Determine Your Spending Categories

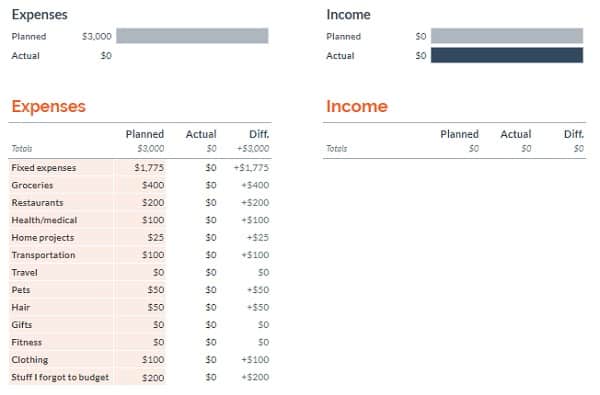

Once you open the monthly budget template, it’s time to get to work on your bare-bones budget.

You can ignore the income side of the spreadsheet if you want. This exercise is about planning your bare-bones expenses.

You can set your own spending categories, but these are pre-filled:

- Food

- Gifts

- Health/medical

- Home

- Transportation

- Personal

- Pets

- Utilities

- Travel

- Debt

- Other

If you already have a monthly budget, this part of the process should only take a moment or two. Just copy your existing categories.

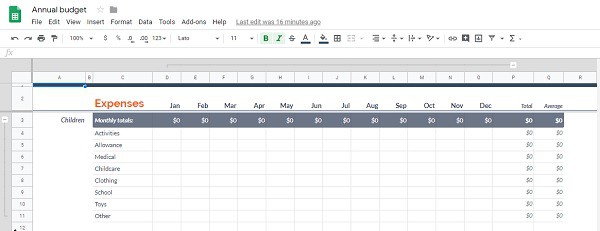

Need some help? Open the “Annual budget tracker” in Google Sheets.

It’s a separate spreadsheet that has a much longer list of sample expense categories so that you don’t forget anything.

Simply add the relevant categories to your bare-bones budget.

3. Plan Your Spending for a Bare-Bones Month

The third step is to plan your spending and come up with a number for the total amount you would spend on expenses in a month.

Remember, this isn’t a typical month. It’s a bare-bones budget after all.

Go through your spending categories one-by-one and estimate how much you would need to spend per month during a financial emergency.

The spreadsheet will total them and you have your bare-bones budget.

Final Thought

After you’ve created a monthly bare-bones budget, multiply your total planned spending by six and that equals a six-month emergency fund.

If you don’t have that much in the bank yet, that’s okay. But start saving.

As you build up a stronger emergency fund, you may find yourself worrying a lot less about money.

If you like the Google Sheets budget template over time and want to step up your budgeting strategy, learn how I customize it to save more money!