If you like to participate in money challenges to reach your financial goals, I want to let you in on a savings strategy I’ve been testing out for the last year involving retail receipts.

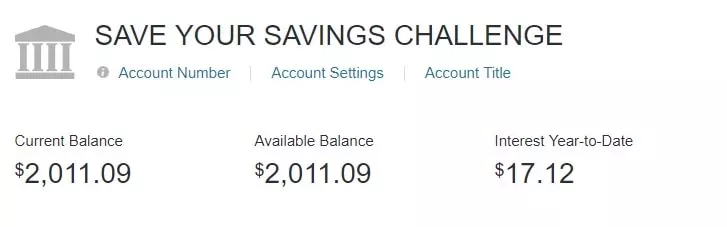

Over a 52-week period, I’ve stashed hundreds of receipts and saved more than $2,000 in the process.

I Call It the “Save Your Savings Challenge”

Here’s how it works: When you purchase something from a retailer that’s on sale, always ask for a receipt and notice the “You Saved” amount listed on the bottom.

The goal with this challenge is to match that amount and put the money in an online savings account!

Take a look at an example…

This receipt from Publix, a supermarket chain, lists a savings amount of $10.16 at the bottom of the receipt. That’s from a store coupon and sale items that I purchased.

But am I really saving anything if I turn around and spend the $10 somewhere else? Of course not!

Instead, I stash the receipt from Publix in a plastic bin (after getting cash back through Ibotta and Fetch Rewards) and don’t touch it until the end of the month.

At that time, I calculate the “You Saved” amount from the Publix receipt and every other receipt I got.

When I add up the grand total for the month, I log in to my online banking account and transfer the amount from my checking account to an online savings account.

But there’s another reason why I collect all of those receipts. When I go through them every month to calculate the “You Saved” amounts, I get one more chance to analyze my purchases.

For example, I noticed early on that I was making too many trips to the store and cut back right away.

I started this challenge in November 2017 and ended up with $2,011 in my online savings account after my first 52 weeks of using this receipt trick.

If you try this challenge, remember to set a goal for your savings — mine will fund a Roth IRA.

The Save Your Savings Challenge is so simple, but the response has been incredible. NBC News wrote an article about my journey after I completed seven months of the experiment.

My success with this strategy also inspired me to start a similar challenge by matching credit card rewards.

The bottom line: There’s a difference between saving money and spending less money. When you buy items at a discount, you’re still spending.

I invite you to try the Save Your Savings Challenge and see if it changes the way you think about shopping.

Save Your Savings Challenge quick tips

- Always ask for a receipt at the checkout

- Use Ibotta and Fetch Rewards to get cash back (mostly grocery receipts)

- Stash your receipts in a box until the end of the month

- Add up the total “You Saved” amounts

- Transfer the money to an online bank that pays interest

- Set a goal for the money that you really saved

Don’t have an online savings account? Get one!

If you don’t already have an online bank, I recommend Discover Bank. I’ve been with them for years and love how they don’t charge all the fees that the big banks do. Read my review here.

Other great online banks include Ally Bank and Capital One Bank if you don’t want to go with Discover.

More Michael Saves Stories You May Like:

- How to Create a Budget With Google Sheets (Step-by-Step Tutorial)

- The Big 3 Credit Card Strategy: How to Maximize Cash Back Rewards

- How to Create a Weekly Money Routine to Save More Money