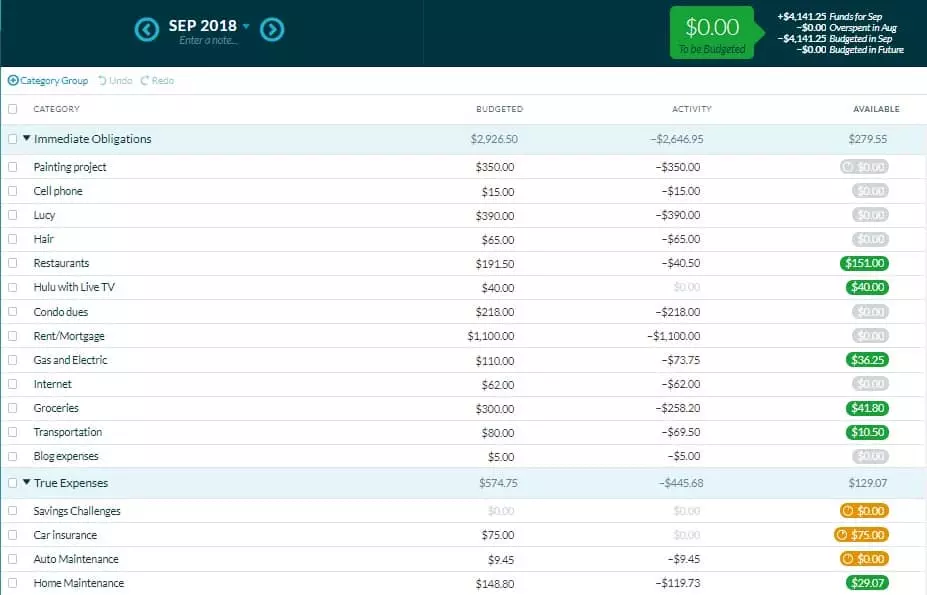

I spent two full months testing out YNAB (You Need a Budget), a subscription-based budgeting tool, and it completely changed the way I manage my finances.

Budgeting has always been one of my strengths. While in my mid-20s, I diligently tracked my income and expenses during the two years and two months that I spent aggressively paying off my mortgage.

Years later, I frequently check both Mint and Personal Capital to make sure that I’m spending less than I earn.

How to Apply the YNAB Method Using Google’s Free Budgeting Spreadsheet

What’s so special about YNAB? The four rules. YNAB’s budgeting method, which is like a digital version of the envelope system, really helped me prioritize my spending and make good decisions.

YNAB’s Four Rules Explained

- Give every dollar a job: When you receive a paycheck, assign it to your expense categories before you spend it.

- Embrace your true expenses: Set money aside every month for non-monthly expenses (property taxes, insurance premiums, holiday gifts, etc.) so that you’re ready when the bills come in.

- Roll with the punches: Things can and will go wrong! Move money around to cover categories where you overspend.

- Age your money: Stuck living paycheck to paycheck? By consistently spending less than you earn, you’ll work toward using last month’s pay on this month’s expenses.

My Experience With YNAB

Like Mint and Personal Capital, YNAB connects to your bank accounts to monitor your transactions. However, I chose to keep my accounts unlinked and manually entered transactions instead.

Using YNAB’s smartphone app to log transactions is so quick and easy — I usually got it done before even leaving the store.

YNAB’s method gave me a reality check a few times. When I overspent on groceries for the month, I had to move money from another one of my budget categories to make up for it — which is the third rule.

Despite several unexpected expenses during both months of my experiment, I managed to save an extra $600 using YNAB’s method.

YNAB’s four rules helped me become more proactive about my spending because I checked the app before buying anything.

Meanwhile, I realized that I’ve been using Mint and Personal Capital for a snapshot of my spending after it’s too late — not hands-on budgeting.

Important note: I still rely on Personal Capital for its free net worth tracker and retirement tools, which are the best I’ve been able to find.

The downside of YNAB is the cost. Mint and Personal Capital are free, but YNAB is $14.99 per month or $99 when you pay annually. The service typically offers a free trial.

How to Apply YNAB’s Method for Free With Google Sheets

Even after my initial success with YNAB, I’m no longer using the service. I’ve decided to apply the method on my own.

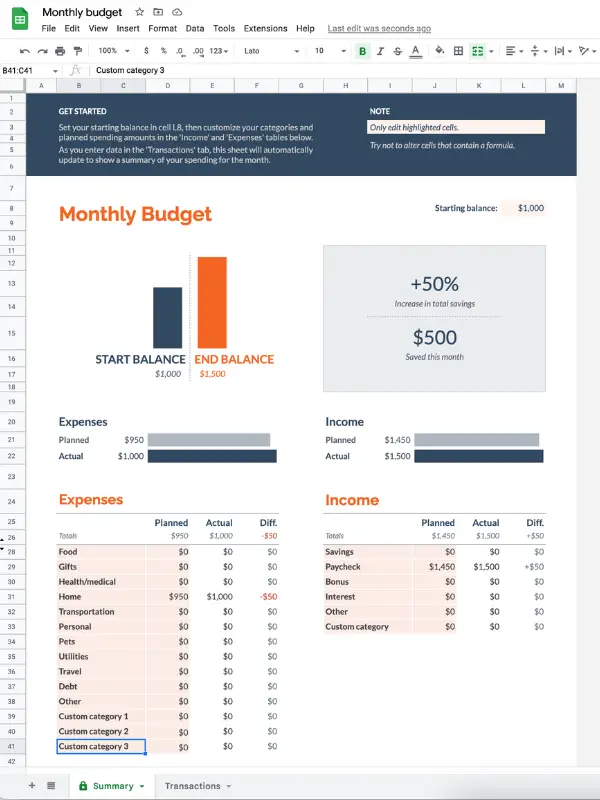

For the second month of my trial, I used YNAB along with the free monthly budgeting template in Google Sheets, which is similar to an Excel spreadsheet. I’m able to enter my transactions using the Google Sheets mobile app almost as easily as I did with YNAB’s app.

I believe it’s the four rules that make YNAB so effective, not necessarily the website and app that they want you to pay for.

With Google Sheets, I set up my budget at the start of the month on a desktop. The sample screenshot below shows the Summary page of the Google Sheets budgeting template that can be customized with your own categories.

The Google Sheets budgeting template also has a second tab for transactions. That’s where I enter my expenses on the go using the Google Sheets mobile app.

When transactions are added, the Summary page updates automatically.

Here’s My Suggestion

Sign up for the free trial of YNAB and decide for yourself if it’s worth it. You may love it and want to become a paying member! But if you don’t, I suggest that you try Google Sheets and my free YNAB method hack.

Want to learn more about budgeting with Google Sheets? Learn about the strategy I use in the video below or by reading this step-by-step guide.

Love this! Like you I was impressed by the YNAB philosophy but cancelled the subscription in the end due to the cost. Now I’m hoping to create a spreadsheet on my iPhone for applying the method. I see how your system applies rule 3 but I don’t get how you integrated rules 1, 2, or 4 into your spreadsheet.

These articles may clear things up:

How to Use the Google Sheets Budget Template https://michaelsaves.com/budgeting/google-sheets-budget-template/

How to Budget for Irregular Expenses with Google Sheets https://michaelsaves.com/save-money/google-sheets-budget-irregular-expenses/

I’m not as strict as YNAB because I have a full emergency fund, but I think you can easily apply the other rules with this template. Good luck.